A recent meeting with a prospective client made me wonder about the wisdom of venture capitalists when it comes to deciding where to park their money.

During our tour of their operations, it rapidly became clear that they were working with no warehouse management systems, a slap-dash layout, and painful processes that seemed to be designed to guarantee that nothing ever made it out the doors in time. Meanwhile, sales were booming and the DC was bustling. After the tour I sat with the COO for what was to be a short and unsuccessful meeting.

“We’re going to raise $100 million in funding and automate the place from start to finish, he told me. No human is going to touch a single product. We’re already in contact with a robotics firm out of Boston.”

Now, one thing I’ve learned in my career as a consultant is that successful client-consultant relationships must be rooted in some sort of philosophical alignment. If the clash in perspective is too important, the relationship will be short and stormy.

Meekly, I offered in response: “That seems to be a big leap from where you are today. There are so many basic things you could do to vastly improve your operations with a fraction of that money.”

“Why take baby steps? The payback will be tremendous,” the COO replied.

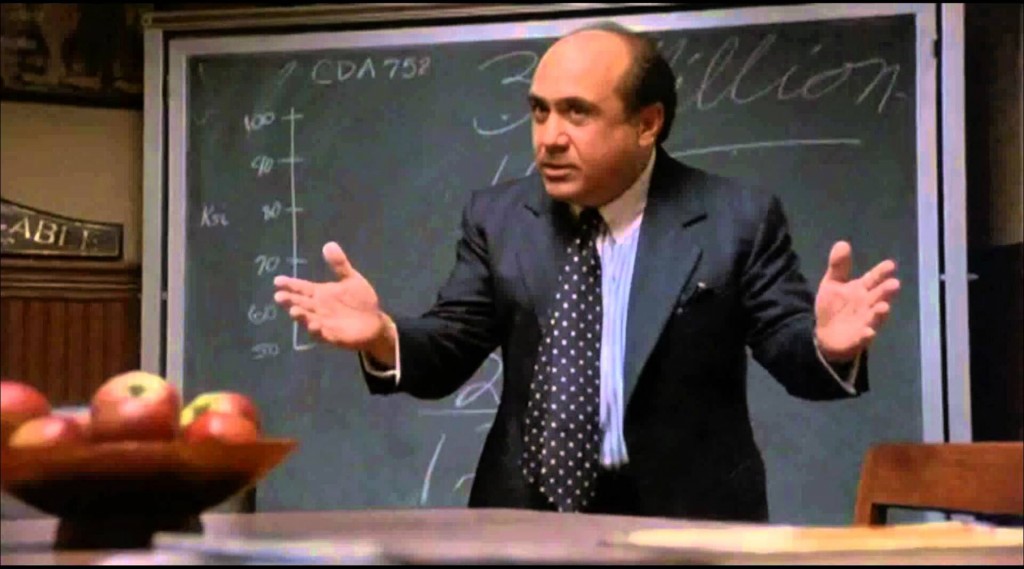

At that moment, I started thinking about that movie starring Danny DeVito: Other People’s Money. Someone else would foot the bill for this COO’s robot dreams. Venture capitalists eager to get a stake in the hottest new company would throw their money away, unaware that the project’s appeal resulted from one of the most basic mistakes supply chain managers make when planning to improve their infrastructure.

The payback on creating a fully automated, robots-only distribution center looked huge to the COO, but that was a mirage, an illusion. Given the state of his DC, implementing any sort of improvement would have made the existing situation better.

It’s tempting to choose a solution that is popular and attractive to a venture capitalist’s eyes. But the way to the most profitable solution always begins with an attempt to make the best out of the existing infrastructure. Alternatives should only be judged against the improved status of your current facility. And then, those alternatives should represent a range of capital investment levels where a mix of technology, materials handling, and buildings solve the problem at hand.

In that context, the economics of the COO’s dreams would evaporate against the simpler options. Consider two investment options. Option A costs $5 million and delivers $5 million in annual savings. Option B costs $100 million and delivers $10 million in annual savings. It would take 19 years for the extra $95 million to pay for itself. Meanwhile, that $95 million could go to other things, like rolling out more facilities faster and cheaper than the COO’s grand fantasies would allow.

A New York Times analysis of Instacart once wondered if we were in a new technology bubble with heap-loads of cash priming the silliest pipe dreams. Today, I’m asking the same question. The moral of the story I’ve just told isn’t that it’s never a good idea to invest large sums to improve your supply chain with new technology. The moral, rather, is that what moves you to invest should always be based on a solid and careful analysis of your actual needs. You want to maximize your return on investment, and there’s generally little return to expect from illusions.