Some questions that I often get from clients are:

- “Should we outsource our distribution and/or transportation?”

- “Is it time for us to insource?”

- “Where is the 3PL market going?”

- “Who are the top 3PL providers and can they fulfill our needs?”

Answers to these questions are complex, but one thing is for sure: due diligence is a necessary first step in evaluating what risks are involved.

While there is no universal response, there are at least two very good sources of information available when looking at the 3PL market and its trends:

- Armstrong & Associates, Inc. – 2011 3PL Market Analysis and 2012 Predictions: 3PLmarket

- 2013 THIRD-PARTY LOGISTICS STUDY” which is published yearly by Dr. John Langley of Penn State University: 2013 3PL Report

Below are some interesting statistics and information from both of these sources.

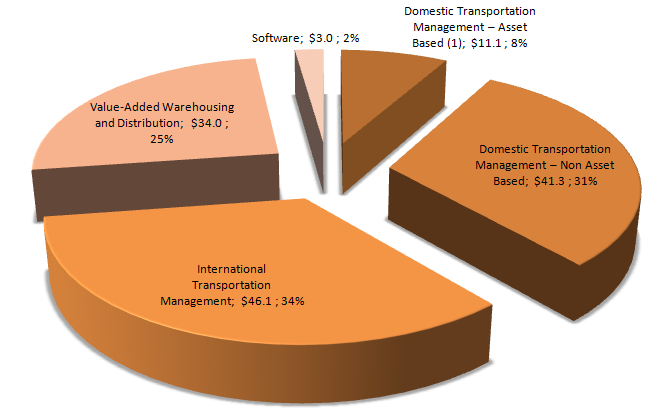

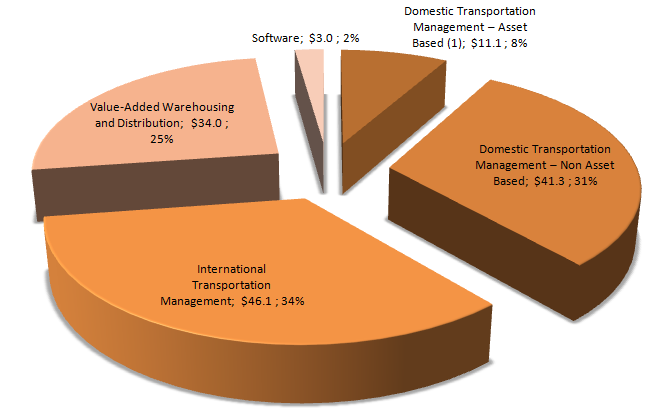

In 2011, the 3rd Party Logistics (3PL) gross revenue/turnover in US$ was a total of $133.8 billion. This can be segmented as follows (in billions):

<sup>(1)</sup> Primarily dedicated contract carriage

The North American 3PL revenues increased by 7.2% between 2010 and 2011. In 2012 the gross revenue is estimated to increase by 6.3%.

- Global revenues for the 3PL sector continues to rise as:

- 65% of existing 3PL shippers are increasing their use of 3PL services. The most frequently outsourced services are: Transportation, Warehousing and Freight Forwarding

- 22% of existing 3PL customers are returning to insourcing of these services

- Shippers (86% of them) and 3PL providers (94% of them) view their relationships as successful

- 15% of shippers report logistics cost reductions

- 8% of shippers report inventory cost reductions

- 26% of shippers report logistics fixed asset reductions

- When looking at Supply Chain Innovation, the study states that “many 3PL-shipper relationships are not set up to support innovation”

- Most 3PL respondents (89%) believe they are ready to innovate. However, only 53% of shippers agree that they are

- The amount of data now generated by the entire supply chain is seen as a hinder to some and as a god-send to others

- The study outlines the challenge of converting this data into a business value driver by labeling it a “disruptive innovation opportunity”

Without a doubt, 3PL providers play a significant role within the supply chain of many organizations. While every company has specific needs and financial objectives, I believe some situations are more appropriate than others in regards to using 3PL provider services. For instance:

- A company that self-distributes is considering introducing a new geographic market; it can minimize risks by turning to a 3PL with distribution assets already in place in that market. If sales targets are met, this company can then evaluate the feasibility of growing its distribution footprint. This can be done via cross-docking facilities, new distribution infrastructures, etc.

The 2013 study also focused on Supply Chain Innovation, Disruption and Strategic Assessment. Many of the shippers prefer 3PL relationships that are tactical and/or operational rather than strategic. This might be due to limited metrics, IT capabilities, agility and flexibility and/or contract terms.

Why are other shippers not using 3PLs? Here are the top 12 reasons listed in the survey:

- Logistics is a core competency at our firm

- Cost reductions would not be experienced

- Logistics too important to consider outsourcing

- Service-level commitments would not be realized

- Corporate philosophy excludes the use of outsourced logistics providers

- We have more logistics expertise than most 3PL providers

- Control over the outsourced functions would diminish

- Too difficult to integrate our IT systems with the 3PL’s systems

- Issues relating to security of shipments

- Inability of 3PL providers to form meaningful and trusting relationships

- Global capabilities of 3PLs need improvement

- We previously outsourced logistics, and chose not to continue

Does this mean that insourcing is better than outsourcing? Well, not necessarily. The question should be: “What is the best solution for us given our goals and constraints?"